Benjamin AI vs Perplexity Finance

Evaluating their capabilities across fundamental and quantitative tasks

Introduction

In this article, I compare Perplexity Finance with Benjamin AI to see how each performs across a range of tasks—from simple queries to more advanced challenges. The post is broken down into clear sections, each showing the results from both tools and discussing what they mean. But before diving into the details, it’s worth briefly explaining why this comparison matters in the first place. So, let’s get into it!

Note: This comparison is only about the Finance section of Perplexity. The broader Perplexity platform is a fantastic service—so effective, in fact, that it’s made Google a little nervous, as more and more people are choosing it over traditional search engines for exploring concepts and getting quick answers.

Why?

The motivation behind this article comes from a wave of recent tweets praising the “extraordinary performance” of Perplexity Finance—claims that, in many cases, seem to mislead users. What’s often presented as an advanced feature is, in reality, just the basics dressed up. This has sparked both support and criticism, with some pointing out issues like inconsistent results, incorrect data, and outdated methods.

Meanwhile, there are other platforms doing a much better job of using AI for investment insights (no, not FinChat, which Perplexity Finance relies on). One standout is Benjamin AI, which prompted me to carry out this comparison and see how both really stack up.

Article layout

This post is structured around a series of questions designed to test and compare the performance of Perplexity Finance and Benjamin AI across a variety of use cases, including:

Portfolio construction and optimization

Strategy backtesting

Fundamental charts (at various time frequencies)

Rolling metrics like beta, correlation, and max drawdown

Financial statements

Macroeconomic impact on major asset classes

Stock screening

Basic queries about stocks and other assets

Advanced queries on stocks and other assets

Each section includes responses from both services. I began each query with Perplexity Finance, followed by Benjamin AI. The answers have not been edited or rephrased—what you see is exactly what each service returned. You're welcome to copy and paste the same prompts into both platforms and run your own side-by-side test.

For complex queries or completely incorrect answers, I have also used Perplexity Labs. However, the issues with the former are:

It takes way too much time (often around 10 minutes vs seconds for Benjamin AI) even for simple queries sometimes to get suspicious results and unknown methodologies

Labs generate Python code on the fly which actually questions the results

For other quick questions I have not used the Labs, as that’s the point of receiving the verifiable answer fast. Nonetheless, you can always do so if you prefer.

The answers are shown via screenshots, except for the first two sections (Portfolio Construction and Strategy Backtesting), where I’ve included screenshots plus brief textual commentary to add more context. After that, I stick to screenshots only—for the sake of consistency and to keep things streamlined.

Apologies for the long read, but the evidence matters—and I know you're up for the deep dive!

(If you don’t want to do so, here is a quick TL;DR)

TL;DR

This article puts Perplexity Finance and Benjamin AI head-to-head across a range of finance-related tasks—from portfolio construction to macroeconomic analysis. While Perplexity shines in areas like financial statement parsing and SEC filings access, it stumbles on more advanced tasks, sometimes delivering incorrect or overly simplified results.

A quick note on Perplexity Labs: while it offers more flexibility for complex queries, it’s slow, opaque in methodology, and often produces questionable outputs—not ideal for professionals who need fast, verifiable answers. Then again, its analytical depth is impressive; however, Benjamin AI can arrive at similar level once we just ask for it.

Benjamin AI, though not without flaws, generally handles complex financial and macroeconomic analysis more effectively and shows stronger potential for serious research.

Bottom line? If you’re a quant or portfolio manager looking for reliable, in-depth insights, Perplexity Finance itself isn’t there yet. It’s great for fast lookups and document extraction, but for real analytical depth, Benjamin AI currently does a better job.

Portfolio optimization and backtesting

This query was a simple: “are you able to run portfolio optimizations".

Perplexity Finance partial answer:

Perplexity Finance full answer:

I am able to assist with portfolio optimization concepts, explanations, and guidance, but I do not directly run portfolio optimization algorithms or execute live computations myself. However, I can explain how portfolio optimization works, describe various methods, and guide you through the process or tools that can perform such optimizations.

Overview of Portfolio Optimization

Portfolio optimization is the process of selecting the best asset allocation to maximize returns for a given level of risk or minimize risk for a given expected return. It involves balancing risk and reward according to the investor’s preferences, constraints, and goals.

Common Portfolio Optimization Methods

Modern Portfolio Theory (MPT): Combines assets with low correlations to reduce risk while aiming for the highest return at a given risk level.

Mean-Variance Optimization (MVO): Allocates assets based on their risk-return trade-off, generating an efficient frontier of optimal portfolios.

Black-Litterman Model: Incorporates investor views with market equilibrium to adjust asset weights more efficiently.

Monte Carlo Simulation: Uses repeated random sampling to model a range of possible portfolio outcomes considering volatility and correlations2.

Risk Parity: Allocates assets to equalize risk contributions, aiming for portfolio stability.

Advanced Approaches

Recent research applies deep learning to portfolio optimization, directly optimizing asset weights without forecasting returns or estimating covariance matrices. This approach can handle constraints like short-selling limits and leverage, and optimize various objectives such as Sharpe ratio or mean-variance trade-offs5.

Practical Steps for Portfolio Optimization

Define investment objectives (time horizon, risk tolerance, return expectations).

Assess data quality and relevant constraints (liquidity, transaction costs).

Choose an appropriate optimization method based on strategy and constraints.

Test the method on historical data or simulations.

Implement and monitor the portfolio, adjusting as needed.

Tools and Implementation

There are online tools and software that perform portfolio optimization using historical return data and various models, including Black-Litterman and mean-variance optimization. Professional advisors or algorithmic platforms often assist investors in applying these methods effectively.

Summary

While I cannot run portfolio optimizations directly, I can help you understand the theory, methods, and guide you on how to approach portfolio optimization using available tools or software. If you want, I can also help explain specific optimization techniques or help interpret optimization results from tools you use.

If you want to proceed with a specific portfolio optimization task, you might consider using specialized software or platforms designed for that purpose, or consulting a financial advisor who can apply these methods to your portfolio.

Benjamin AI partial answer:

Benjamin AI full answer:

Yes, I can absolutely run portfolio optimizations! I have access to sophisticated portfolio optimization capabilities through my specialized Portfolio Agent.

Here's what I can do for portfolio optimization:

Optimization Models Available:

Mean-Variance Optimization - Classic Markowitz approach balancing risk and return

Risk Parity - Equal risk contribution from each asset

Hierarchical Risk Parity (HRP) - Advanced diversification using machine learning

Hierarchical Equal Risk Contribution (HERC) - Enhanced risk-based allocation

Optimization Objectives:

Maximum Return - Highest expected returns (available for mean-variance and risk parity)

Minimum Risk - Lowest portfolio volatility

Maximum Sharpe Ratio - Best risk-adjusted returns

Maximum Utility - Optimal risk-return trade-off based on risk aversion

Portfolio Types:

Custom Asset Portfolios - You provide the specific stocks/assets

Benchmark Portfolios - Using major indices (S&P 500, Nasdaq 100, Russell 2000, bonds, commodities, Bitcoin, USD)

Buy-and-Hold Strategies - Long-term allocation optimization

What I Can Analyze:

Optimal asset weights and allocations

Expected returns, volatility, and Sharpe ratios

Risk contributions by asset

Portfolio performance metrics

Efficient frontier analysis

Backtesting results with detailed statistics

Would you like me to run a portfolio optimization for you? Just let me know:

What assets you'd like to include (or if you want me to suggest some)

Your preferred optimization approach

Any specific constraints or objectives you have in mind

I can handle everything from simple 2-asset portfolios to complex multi-asset allocations!

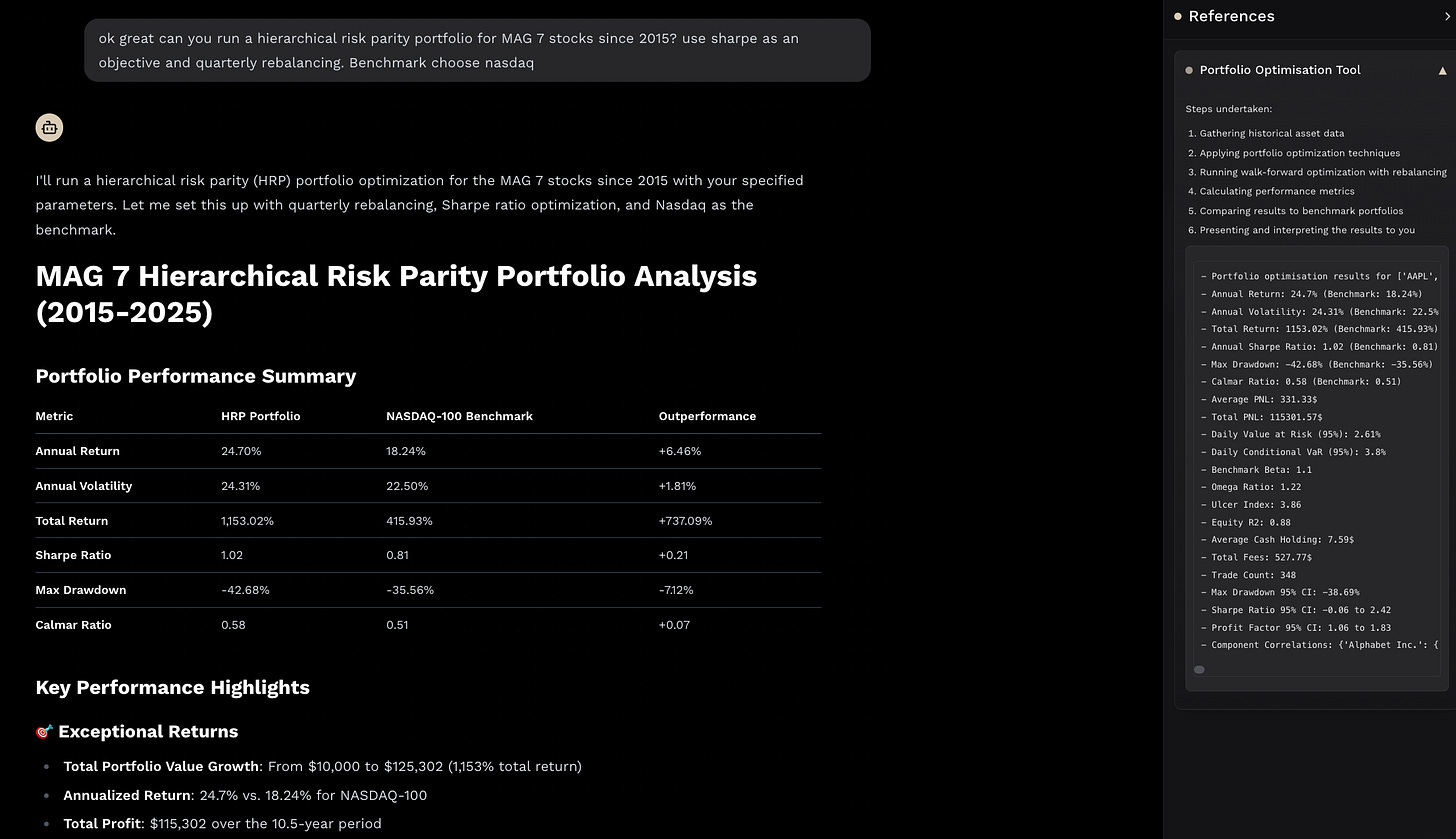

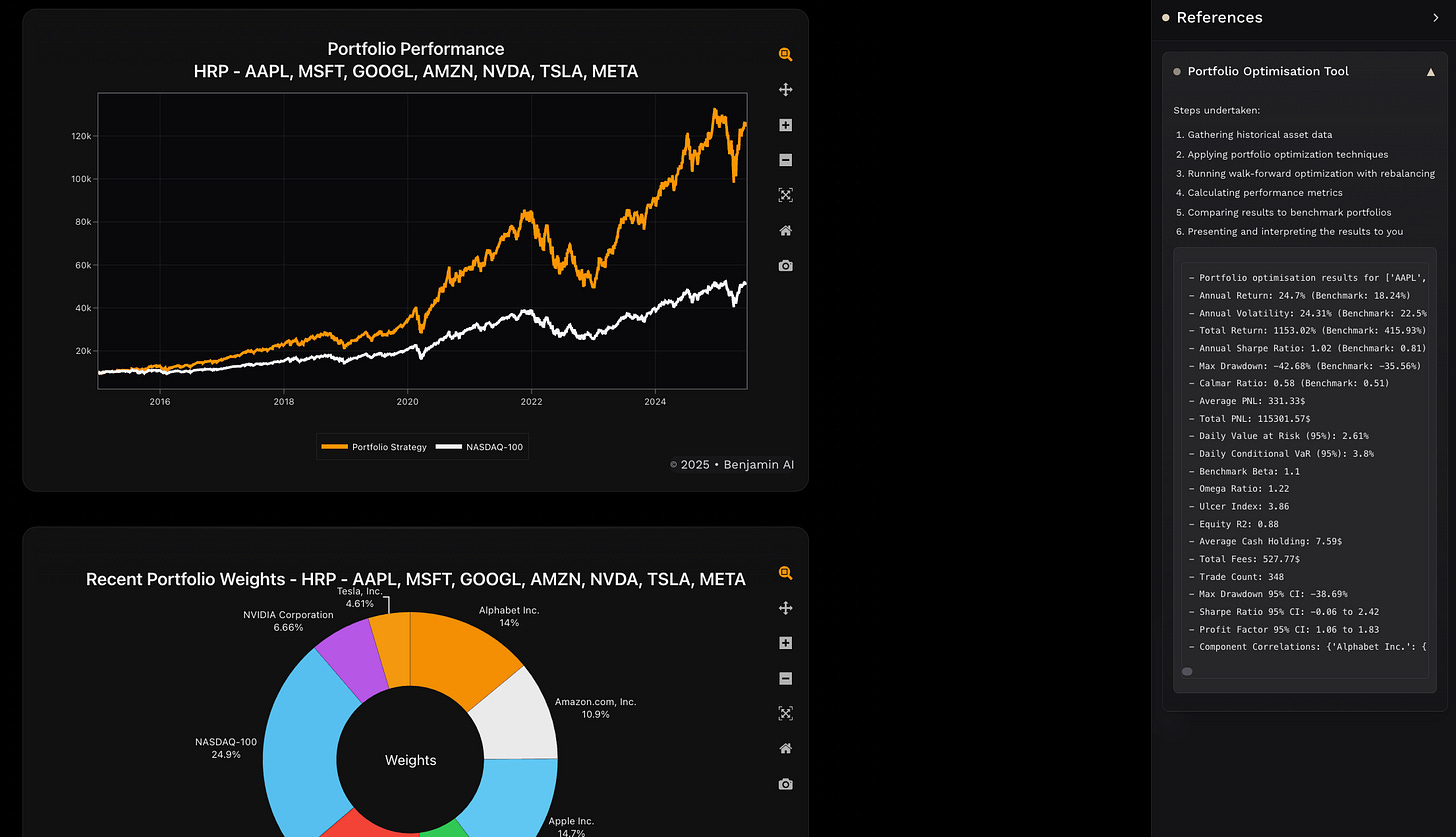

Evidence:

I have asked Perplexity Labs to do same and after 10 minutes of executing the code on the go I got this: https://www.perplexity.ai/search/can-you-run-a-hierarchical-ris-M9hny854QruKz6TNOPNMTw. The analysis looks good; however, the numbers are completely unverifiable and the methodology is unknown (i.e., how the signal is executed, what about the costs, and so on). Benjamin AI makes sure there is no look-ahead bias and costs are included, both in terms of fees (can be set up by the users) and slippage (volatility and volume-based).

Discussion

Here actually we cannot be surprised. Benjamin AI’s edge is running portfolios given various styles and objectives. Perplexity Finance is not there yet, thus I admit, this comparison has been pretty unfair.

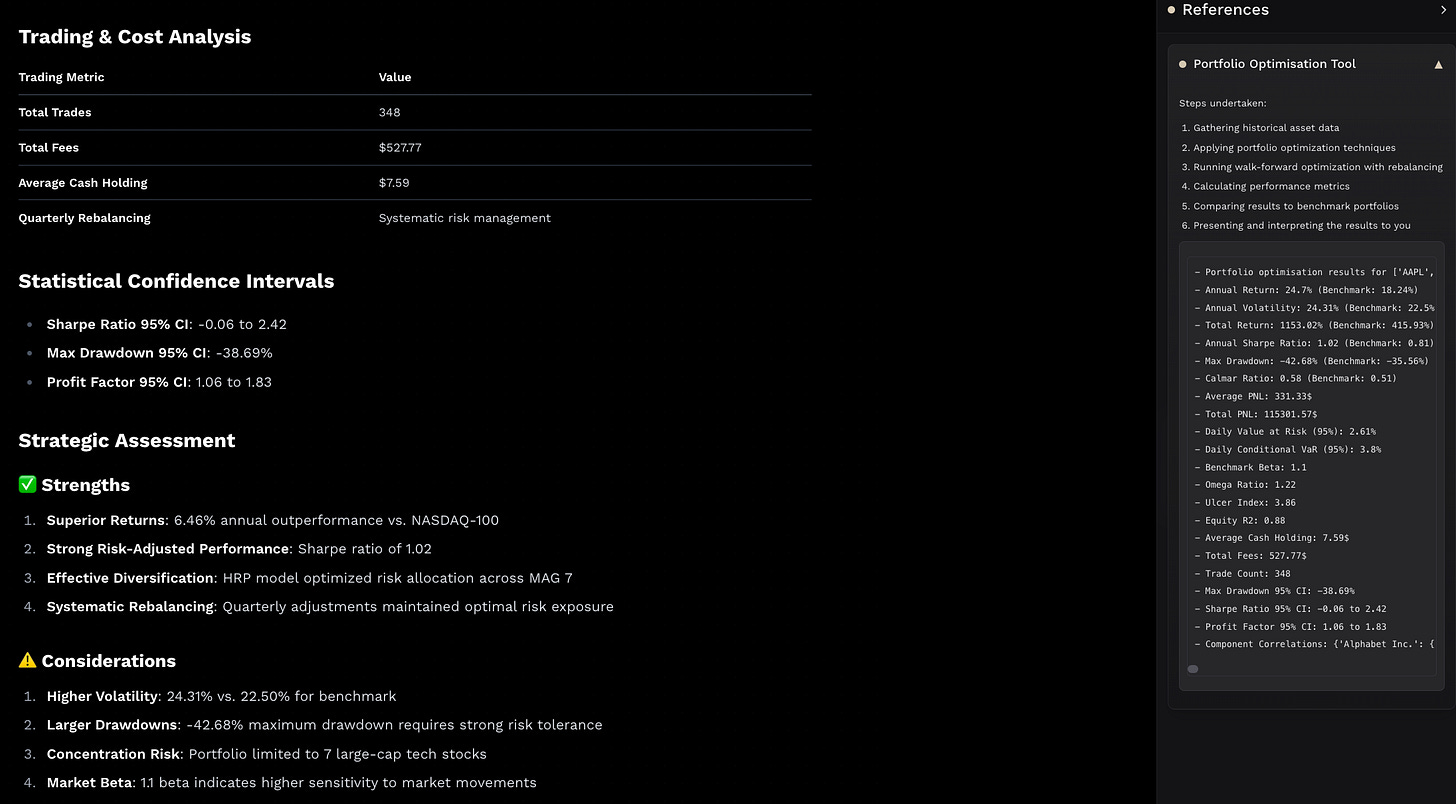

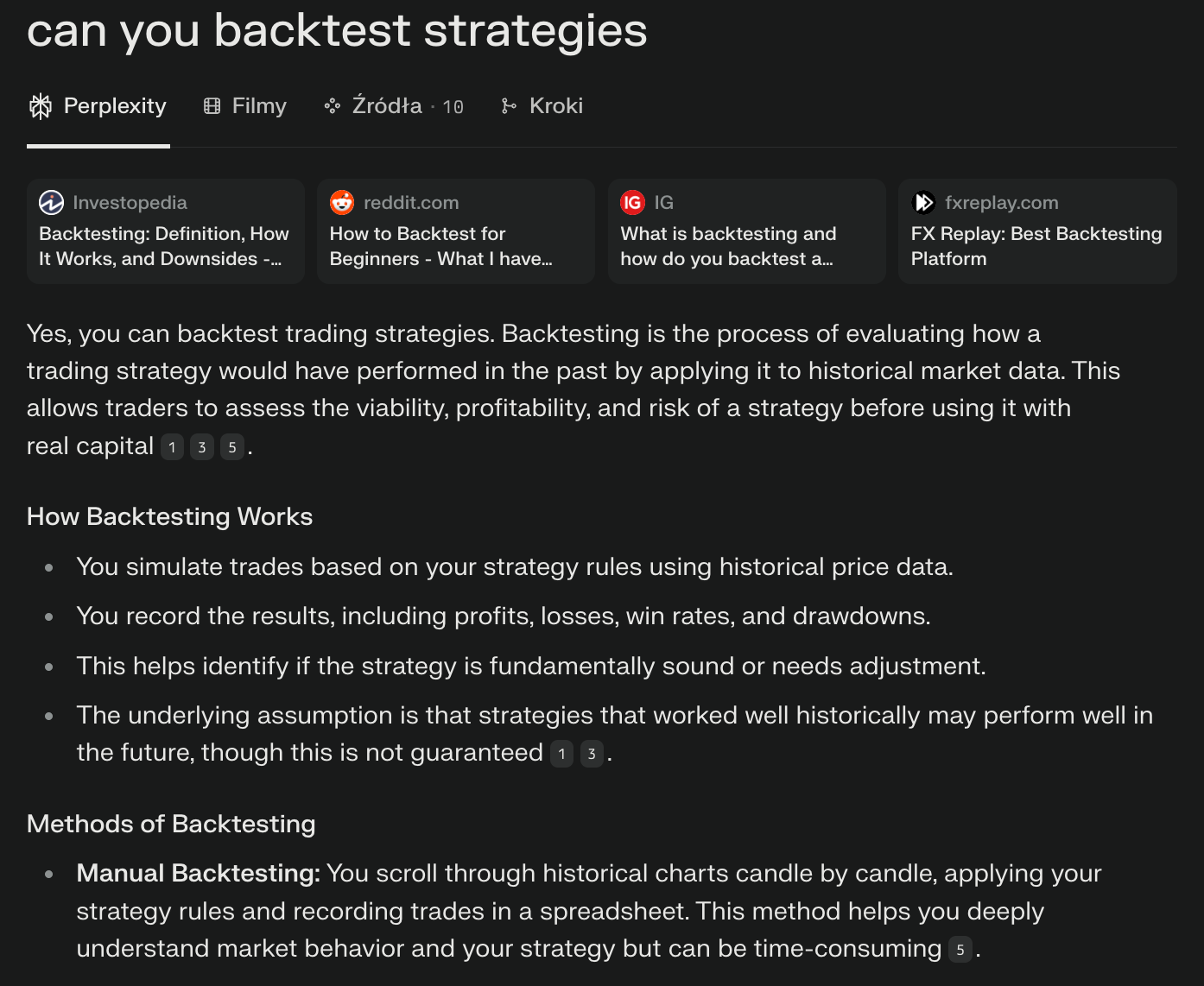

Strategy backtesting

Here I have asked another simple query: “can you backtest strategies”.

Perplexity Finance partial answer:

Perplexity Finance full answer:

Yes, you can backtest trading strategies. Backtesting is the process of evaluating how a trading strategy would have performed in the past by applying it to historical market data. This allows traders to assess the viability, profitability, and risk of a strategy before using it with real capital.

How Backtesting Works

You simulate trades based on your strategy rules using historical price data.

You record the results, including profits, losses, win rates, and drawdowns.

This helps identify if the strategy is fundamentally sound or needs adjustment.

The underlying assumption is that strategies that worked well historically may perform well in the future, though this is not guaranteed.

Methods of Backtesting

Manual Backtesting: You scroll through historical charts candle by candle, applying your strategy rules and recording trades in a spreadsheet. This method helps you deeply understand market behavior and your strategy but can be time-consuming.

Automated Backtesting: You use software or trading platforms (like MetaTrader 4, TradingView, NinjaTrader, or Amibroker) to input your strategy rules and run simulations quickly over large datasets. This method is faster and reduces bias.

Tools and Platforms

MetaTrader 4 has a Strategy Tester for backtesting automated trading programs (Expert Advisors).

TradingView offers a Bar Replay Tool to simulate market conditions and test strategies visually6.

FX Replay is a specialized platform that allows backtesting multiple assets and charts simultaneously with advanced analytics.

Best Practices

Use a relevant timeframe for your trading style (e.g., 1-2 years for daily charts, 3-6 months for scalping).

Define clear entry, exit, and risk management rules before testing.

Consider trading costs and slippage, which may not be included in backtests but affect real trading results.

Test your strategy on out-of-sample data or different time periods to confirm robustness.

In summary, backtesting is a crucial step in developing and validating trading strategies, and there are many tools and methods available to perform it effectively.

Benjamin AI partial answer:

Benjamin AI full answer:

Yes, I can backtest a wide variety of trading strategies for you! I have access to a specialized Strategy Backtesting Agent that can test different types of strategies with comprehensive performance analysis.

Supported Strategy Types:

Technical Indicators:

Moving Averages: Simple (SMA), Exponential (EMA), Weighted (WMA), Triple Exponential (TRIX)

Momentum Oscillators: RSI, Stochastic Oscillator, Rate of Change (ROC), Williams %R

Volatility Indicators: Average True Range (ATR), Bollinger Bands

Volume Indicators: Chaikin Money Flow, Money Flow Index (MFI)

Trend Indicators: MACD, Commodity Channel Index (CCI)

Benchmark Strategies:

Buy and Hold: For any asset or major indices (S&P 500, Nasdaq 100, Russell 2000, bonds, commodities, Bitcoin, etc.)

What I Can Provide:

When backtesting strategies, you'll get comprehensive analysis including:

Performance Metrics: Total returns, annualized returns, volatility, Sharpe ratio

Risk Analysis: Maximum drawdown, downside deviation, risk-adjusted metrics

Trade Statistics: Win rate, average trade duration, number of trades

Visual Charts: Performance curves, drawdown analysis, trade signals

Benchmark Comparisons: How your strategy performs vs buy-and-hold

How to Get Started:

Just tell me:

What strategy you want to test (e.g., "RSI strategy", "moving average crossover")

Which asset(s) to trade (stocks, ETFs, crypto, etc.)

Time period for the backtest

Any specific parameters (optional - I can use defaults)

For example: "Backtest an RSI strategy on Apple stock over the last 5 years" or "Test a simple moving average strategy on the S&P 500"

Would you like to backtest a specific strategy? I'm ready to help you analyze its historical performance!

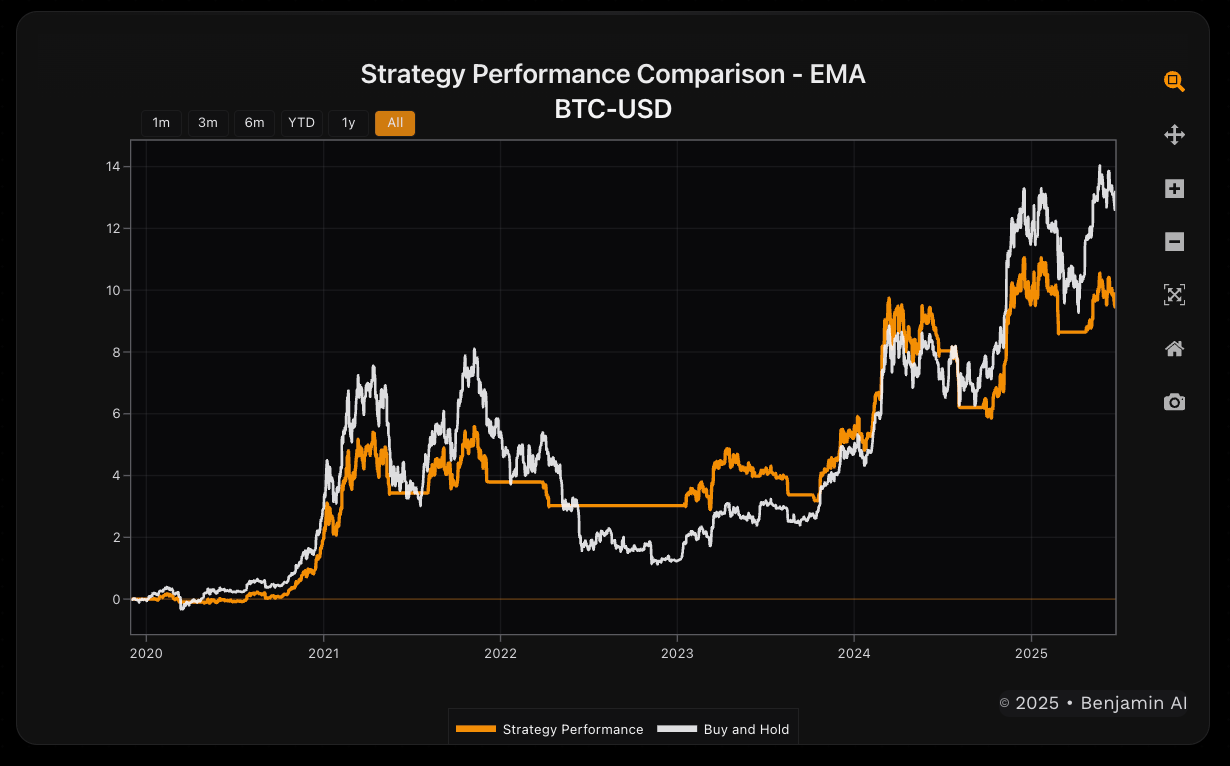

Evidence (not the example question, as this would be less convincing):

Here is Perplexity Labs analysis: https://www.perplexity.ai/search/run-an-exponential-moving-aver-PX90W75hSmmDzoPKoS1L.Q. Same issue as above, solid analysis but takes too long, and it is unclear how the strategy has been generated. Also, the problem is a lack of benchmark comparison, which means one must specify it in the first place.

Discussion

Another unfair question to be honest, as, again, this is Benjamin AI’s edge. However, interestingly, Perplexity Finance did not understand the question the same way Benjamin AI did, although Perplexity Labs managed to arrive at an analysis which is not bad at all.

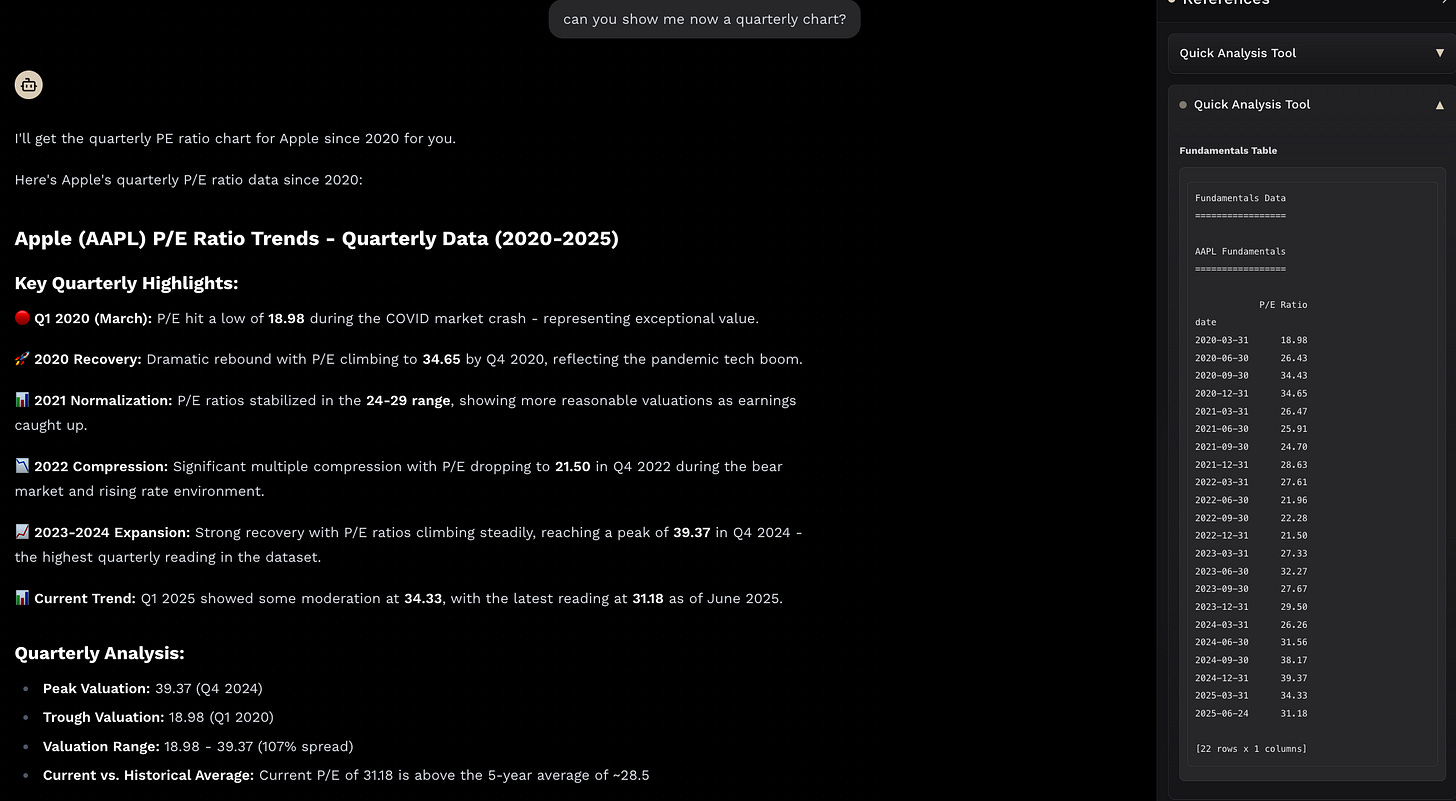

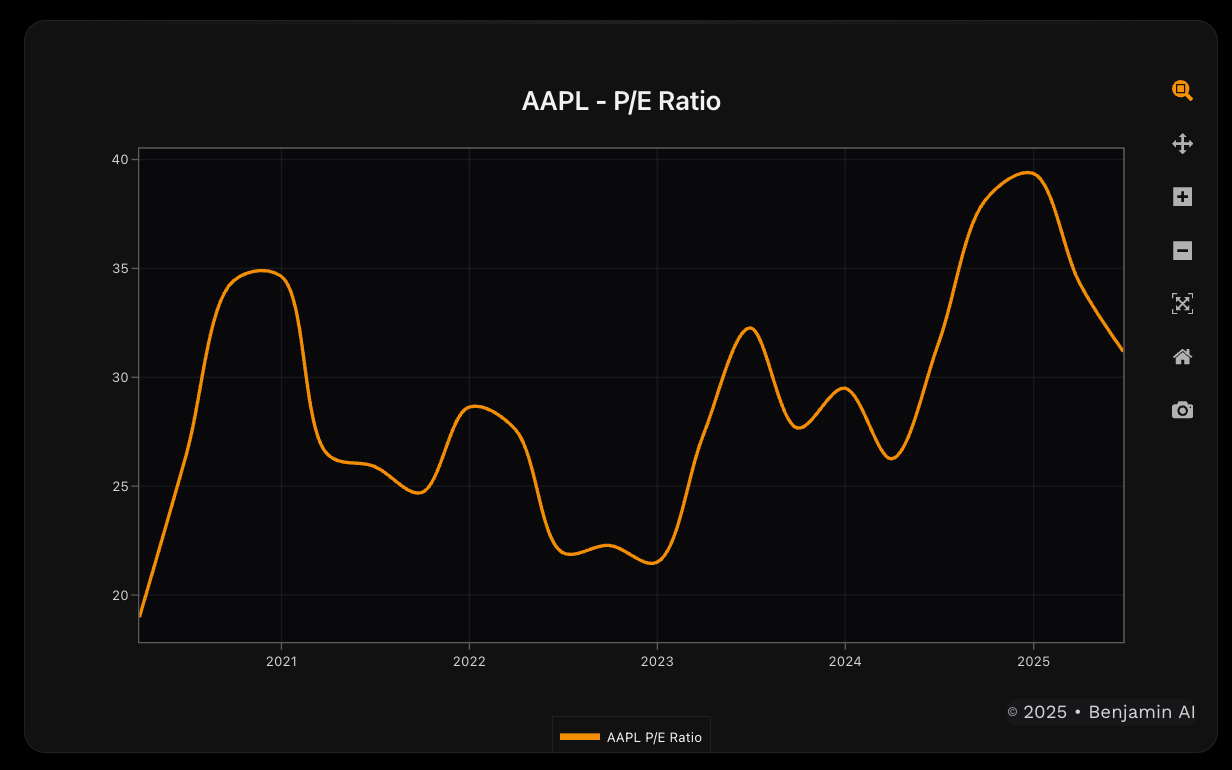

Fundamental charts (with different frequencies)

Here we just want fundamental charts of the same stock: Apple. However, we want them in 1) monthly and 2) quarterly frequencies.

Query: “can you show me a monthly chart of pe ratios for Apple since 2020”.

Perplexity Finance answer:

Benjamin AI answer:

Discussion

Perplexity Finance provided actually quarterly chart with some small analysis. Benjamin AI shows indeed a monthly chart. Here is the Benjamin AI’s answer on quarterly chart (no need to do so for Perplexity Finance, as it has already provided us the quarterly chart):

A clear difference between both.

Rolling metrics

Next, we turn to the concept of rolling metrics—specifically: (1) betas, (2) correlations, and (3) maximum drawdowns. While these are relatively quick queries, they’re far from trivial.

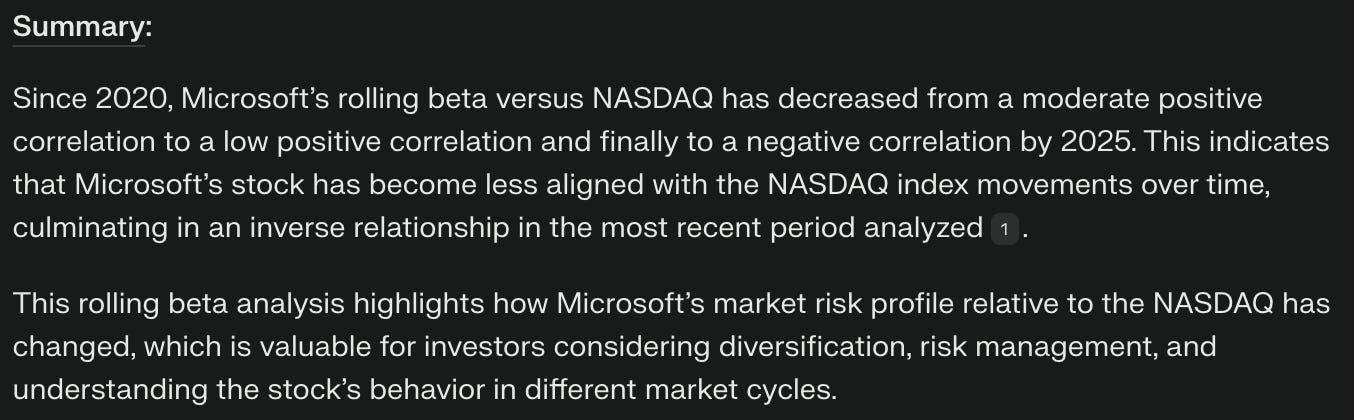

Query: “analyze rolling beta of microsoft vs nasdaq since 2020”.

Perplexity Finance answer:

Benjamin AI answer:

Discussion

Perplexity Finance didn’t provide a chart for the rolling beta, making it difficult to verify the numbers directly. However, it did analyze the data it retrieved appropriately. Benjamin AI, on the other hand, initially had an issue with the benchmark—but it adapted by switching from the Nasdaq index to the Nasdaq ETF (QQQ), which ultimately allowed it to complete the full analysis.

Another query: “what are the rolling correlations of apple vs tesla since 2015? use monthly frequency”.

Perplexity Finance answer:

I took a shot and run Perplexity Labs for this one: https://www.perplexity.ai/search/what-are-the-rolling-correlati-5NQPRhUgTpeo4sYr2yaCsQ. The answer is solid and deep, though here some people would prefer a fast chart + some context; otherwise the question would be specified differently.

Benjamin AI answer:

Discussion

Perplexity Finance again did not show the chart plus provided unverifiable data, so I had to ask Perplexity Labs which has done the job, although, in my opinion, went too deep (yet I understand, some people may actually prefer that). Benjamin AI has also completed its task successfully but provided more concise response; in fact, one can ask for going deeper and running different rolling windows as well as frequencies.

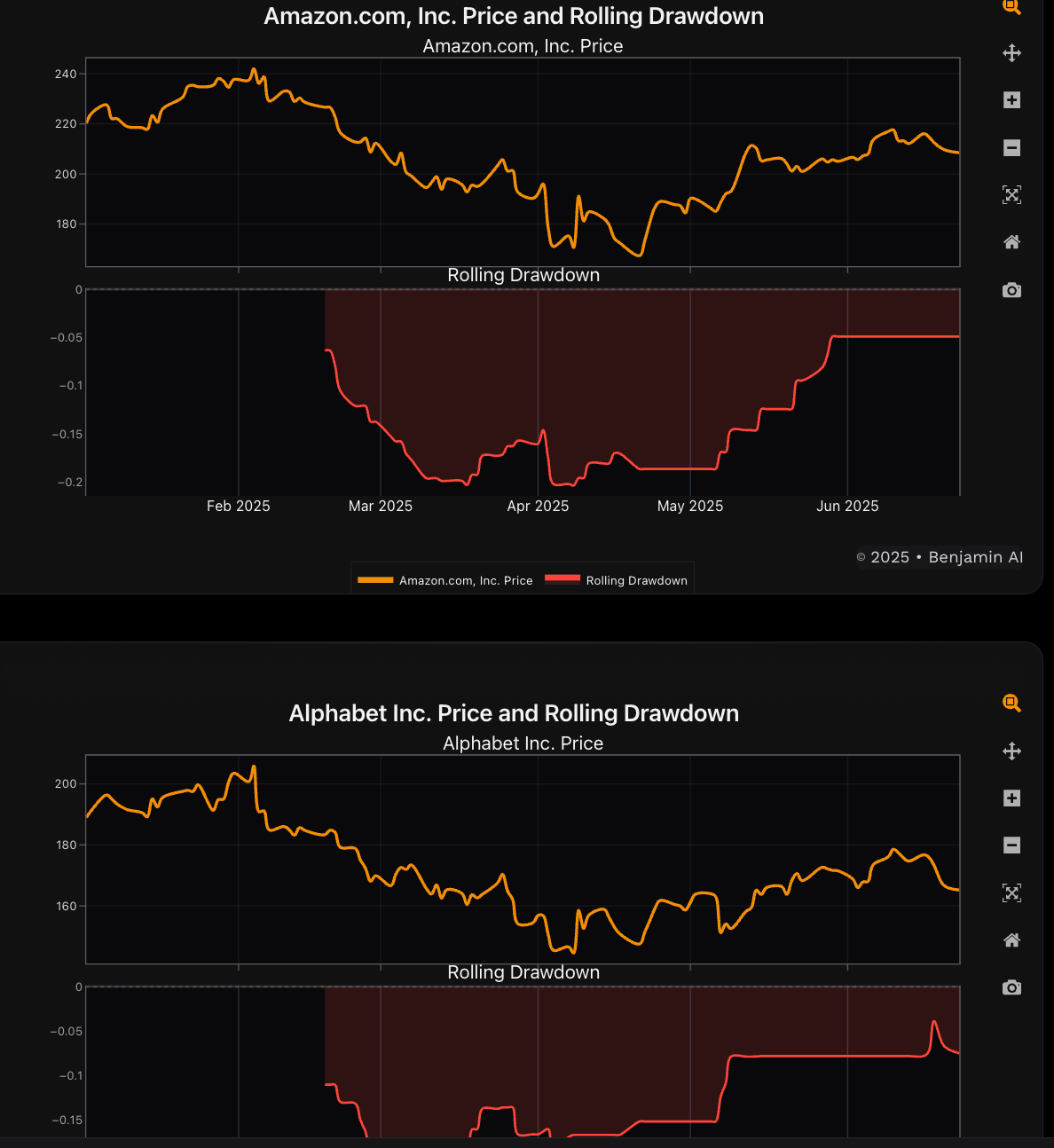

Lastly, the maximum drawdown question: “can you analyze ytd rolling maximum drawdowns of MAG 7”

Perplexity Finance answer:

Perplexity Labs (since the above answer is completely wrong): https://www.perplexity.ai/search/can-you-analyze-ytd-rolling-ma-.CnuMeIaSaeE_DKhxdXrNw. I like this answer - the numbers are correct and the analysis is quite deep. Although, as always, it took too long and the rolling drawdown chart is wrong.

Benjamin AI answer:

Discussion

Again, Perplexity Finance has not provided us with the answer we expect, so we had to reach out to Perplexity Labs which made me forgot I was even running it. Benjamin AI has correctly answered fast.

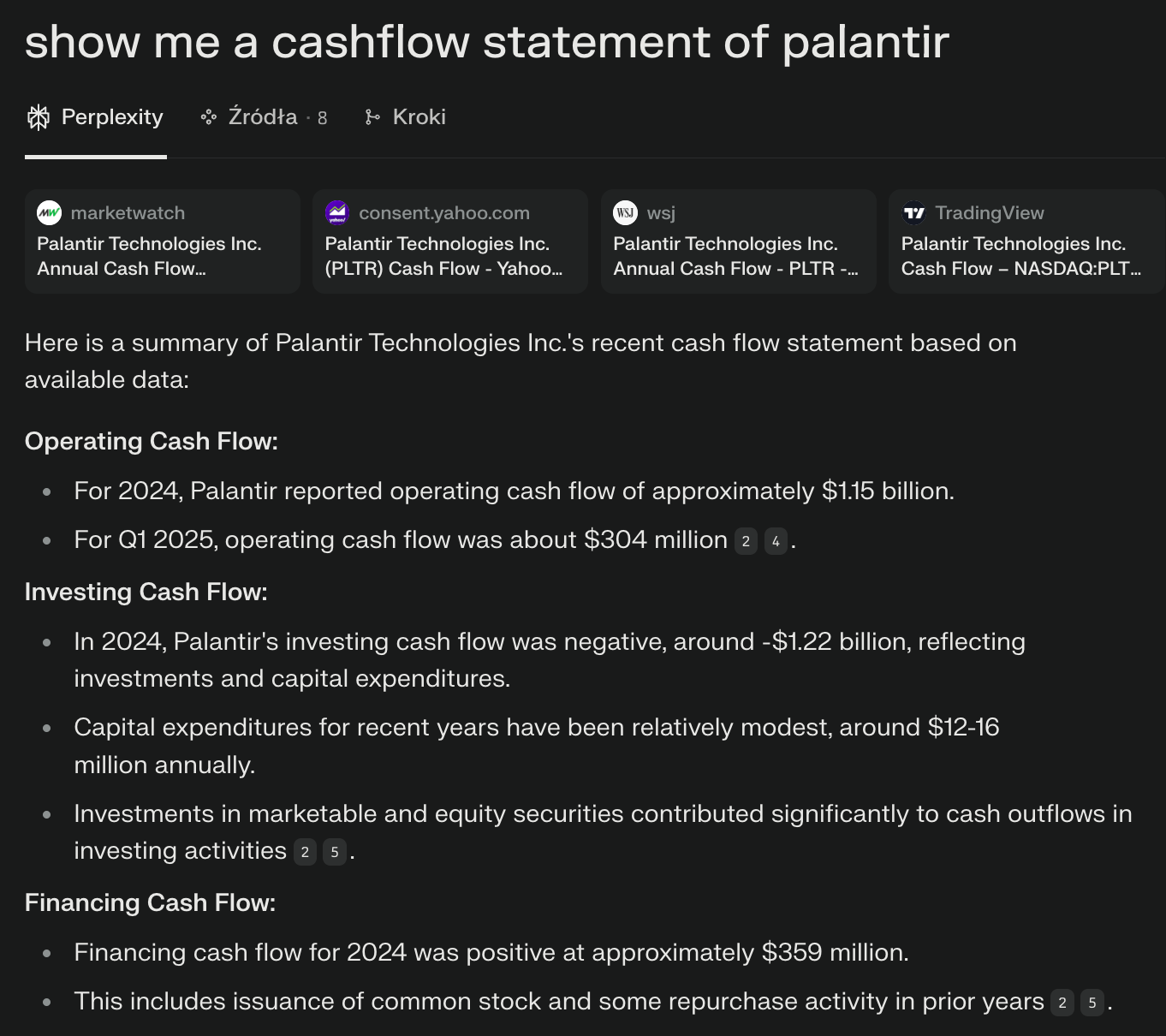

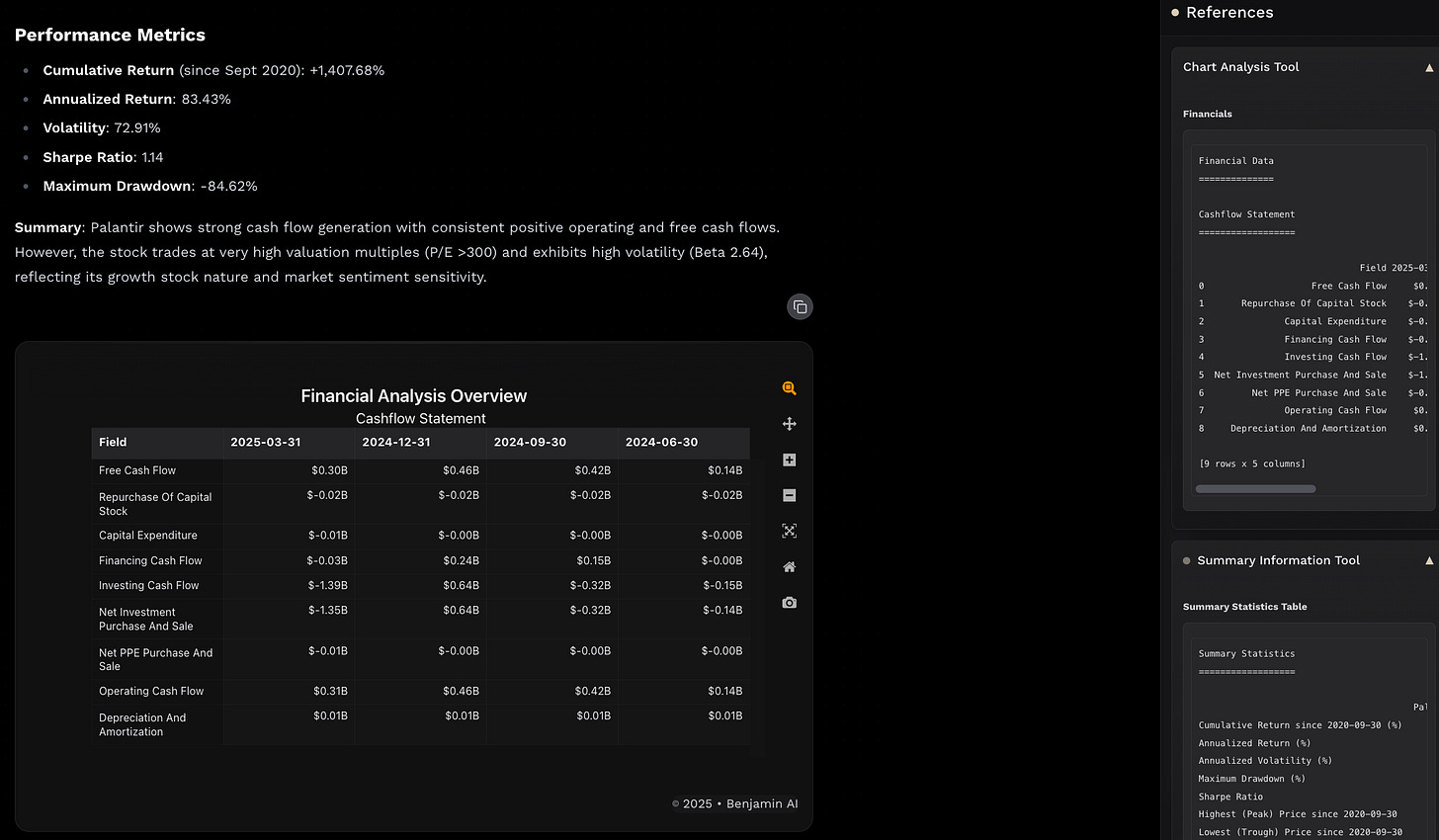

Financial statements

Here we go over basic financial statement questions. Let’s start with just one: “show me a cashflow statement of palantir”

Perplexity Finance answer:

However, when we go into financials tab it looks far better, for instance:

Benjamin AI answer:

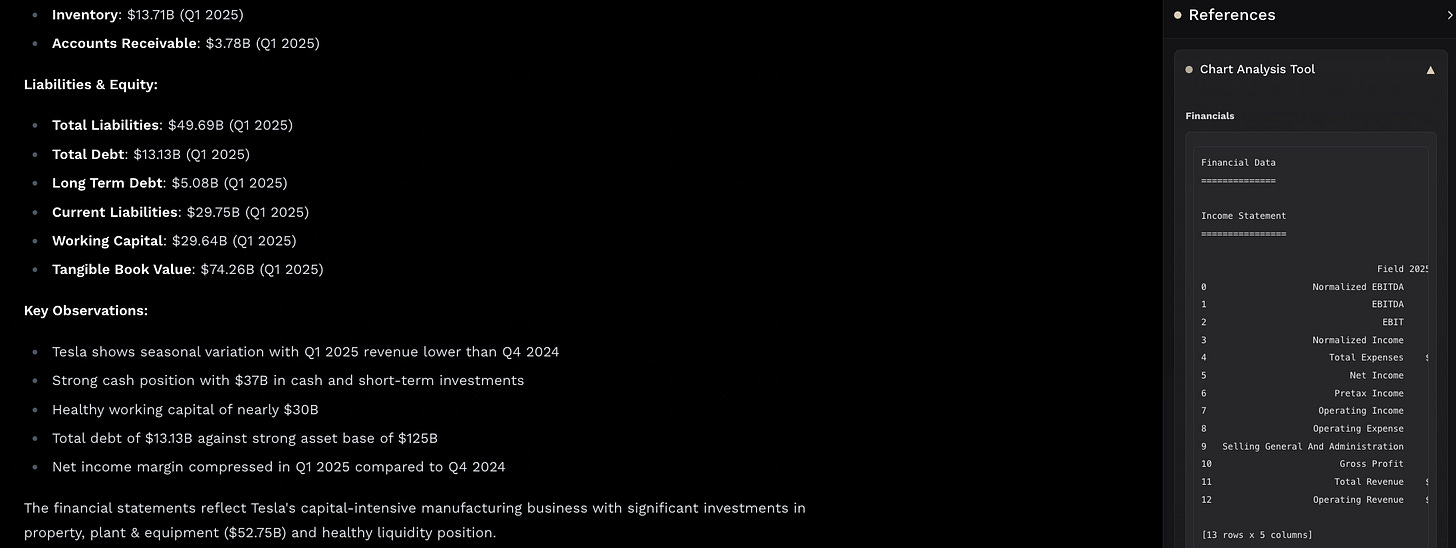

Another query: “show me balance sheet and income statement of tesla”. This time we ask about a couple of statements to pull and quickly analyze.

Perplexity Finance answer:

However, obviously we cannot forget about the financial analysis part mentioned above which allows to analyze financial statements with larger depth.

Benjamin AI answer:

Discussion

Both services provide access to cash flow statements, but Benjamin AI offers more detailed results through direct queries. That said, Perplexity Finance stands out with a superior financial analysis tool—it enables deeper exploration of a stock’s financial statements, both current and historical. In comparison, Benjamin AI hasn’t reached that level yet.

Macroeconomic analysis

Let’s start with a simple query: “what's the impact of yoy inflation on S&P 500? do since 1980“

Perplexity Finance answer:

Benjamin AI answer:

Discussion

Perplexity Finance uses scraped analysis, while Benjamin AI goes deep into the subject, including investment recommendations. However, initially Benjamin AI, instead of doing yearly analysis, does monthly, which is not what we have asked for. Nonetheless, a follow-up question solves this problem; interestingly, Benjamin AI compares annual to monthly analysis:

Let’s go a bit deeper and ask this: “how does real GDP affect interest rates? Do quarterly since 1950”

Perplexity Finance answer:

Since the question is a bit more complicated, I have powered up Perplexity Labs: https://www.perplexity.ai/search/what-are-the-rolling-correlati-5NQPRhUgTpeo4sYr2yaCsQ (scroll down). The answer is very similar to the Benjamin AI’s below, though, in my opinion, some charts and related analyses are better and dive deeper.

Benjamin AI answer:

Discussion

Perplexity Finance relies solely on web scraping, hence we needed the Labs to get the proper analysis we wanted. On the other hand, Benjamin AI goes a step further by including an S&P 500 analysis in its response. Interestingly, though, that wasn’t what we asked for. While the extra insight is appreciated, our focus was specifically on real GDP versus Fed Funds; this is also why the rolling correlation part was missing. Sure, a follow-up question could clarify things—but ideally, it wouldn’t be necessary. (You can ask this question yourself).

Stock screening

This is a subject that causes a lot of commotion when Perplexity Finance showed their capabilities in this area (remember PepsiCo worth $345T?). Let’s just ask a simple question: “show me top 10 stocks with pe ratio < 10, div yields > 3%, and altman zscore > 2”

Perplexity Finance answer:

Benjamin AI answer:

Discussion

Both services pulled 10 stocks with the specified criteria; however, Perplexity Finance offered imprecise data (some was inferred, some unspecified). In addition, seems that not all stocks were US but this is fine. Benjamin AI, additionally, included stocks with market cap higher than $250M (to avoid small caps) and made sure PE ratios are non-negative.

Basic asset queries

Let’s now focus on typical queries one may just search for. For instance, “what’s the ytd performance of MAG 7?”

Perplexity Finance answer:

Benjamin AI answer:

Discussion

Perplexity Finance completely missed the mark by failing to identify what the MAG 7 is—ironically, the same question it recently highlighted in an interview comparing itself to Bloomberg, which now feels somewhat staged. In contrast, Benjamin AI successfully retrieved the relevant information. However, it didn’t produce any charts, which could be considered a shortcoming. That said, the following query addresses this gap:

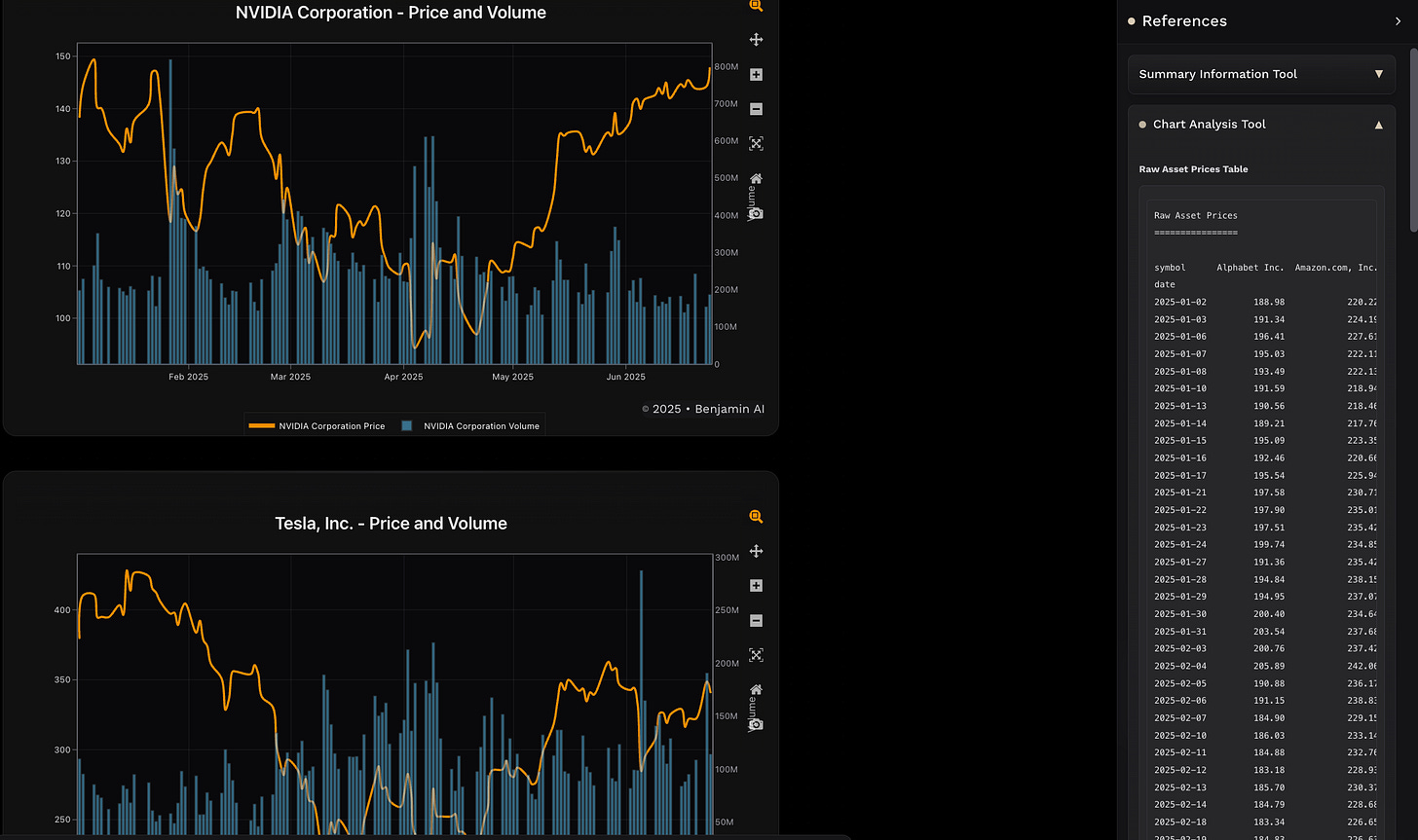

Let’s try another query: “what’s going on with amazon lately?”

Perplexity Finance answer:

Benjamin AI answer:

Discussion

I am actually surprised by Perplexity’s mediocre answer. I was absolutely certain it would crush Benjamin AI’s; however, this has not been the case. I am actually perplexed why. However, I am sure Perplexity Labs would have done the job, since the question is rather basic.

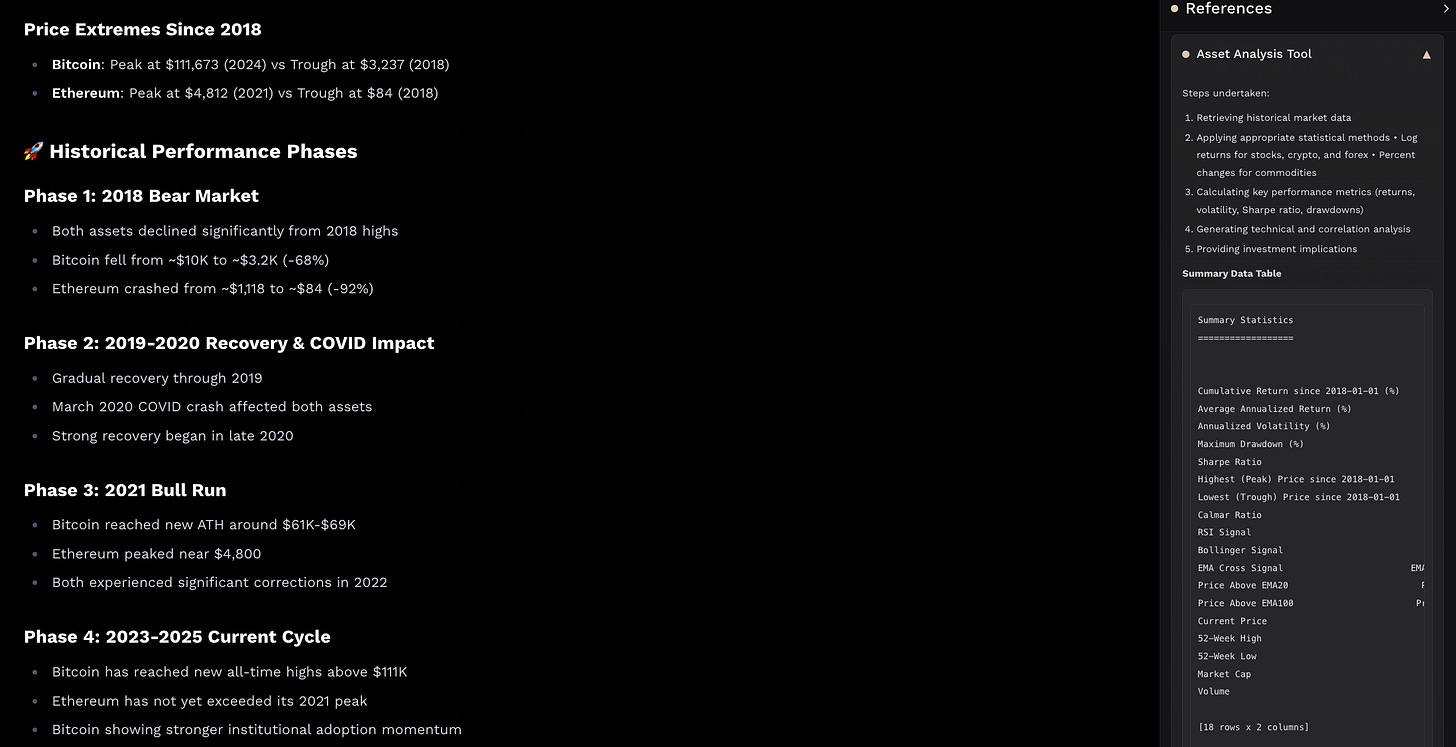

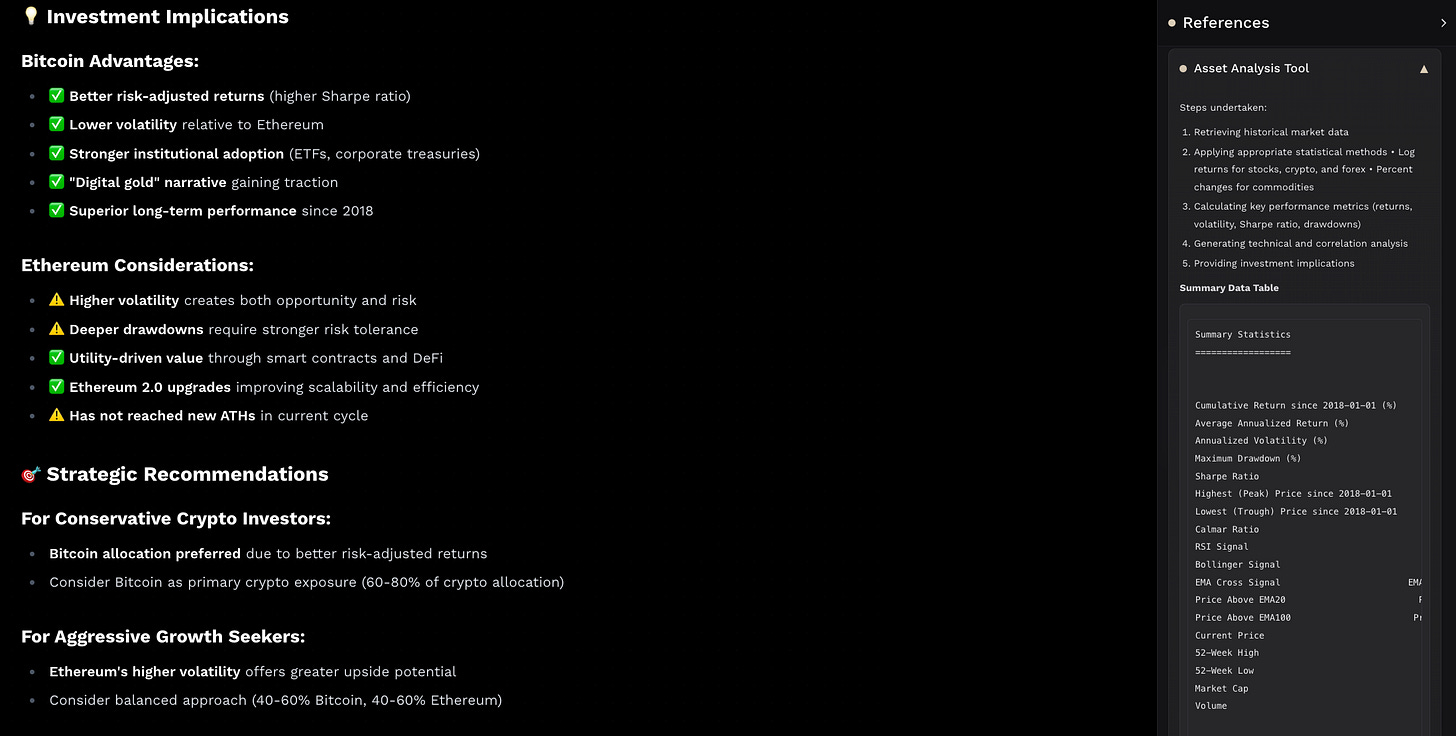

Let’s move on to crypto and ask: “can you analyze bitcoin and ether since 2018?”

Perplexity Finance answer:

Benjamin AI answer:

Discussion

Benjamin AI provides a way more comprehensive answer, as it - again - does more profound study on the data it has got. Perplexity Finance just scrapes web again.

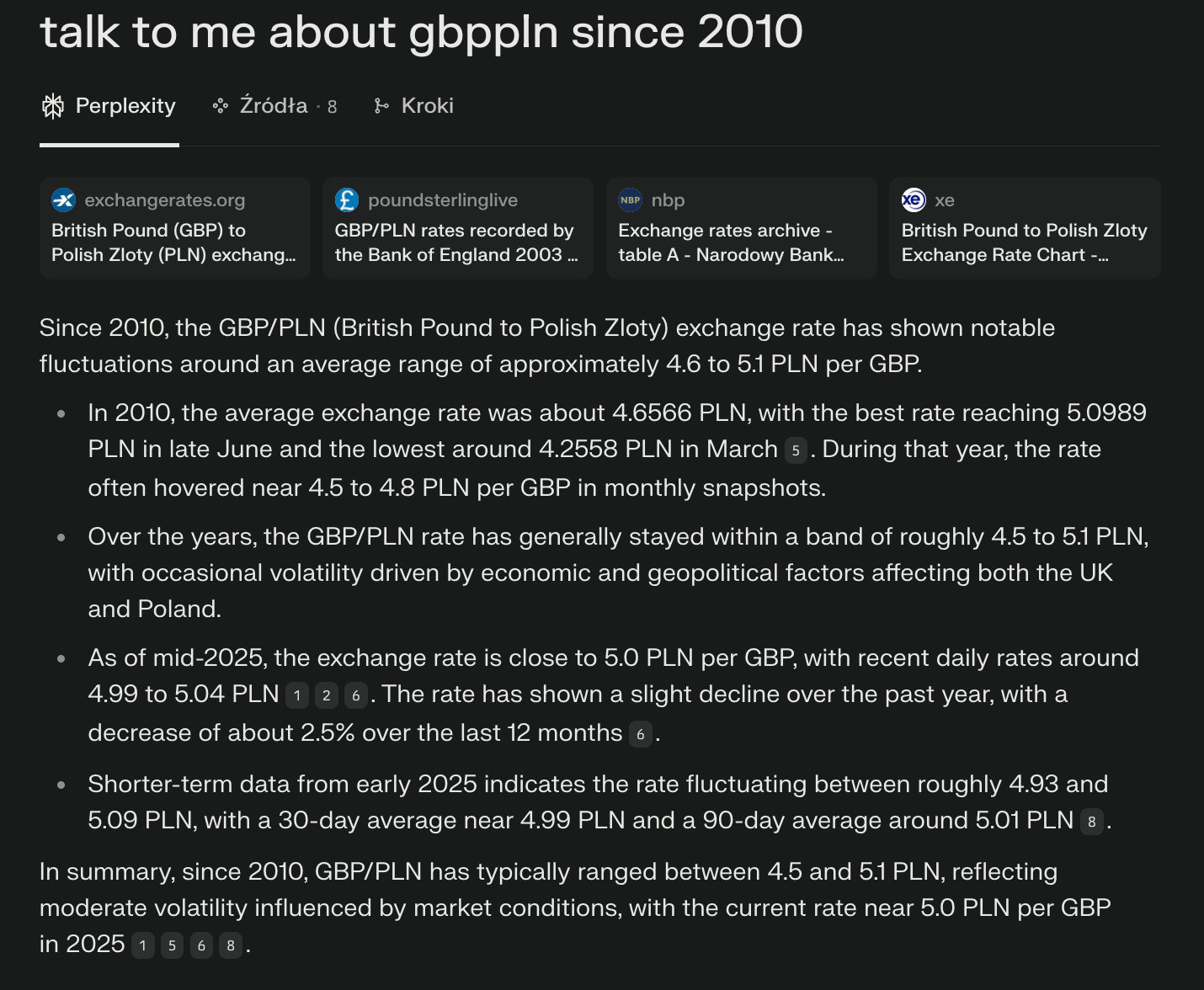

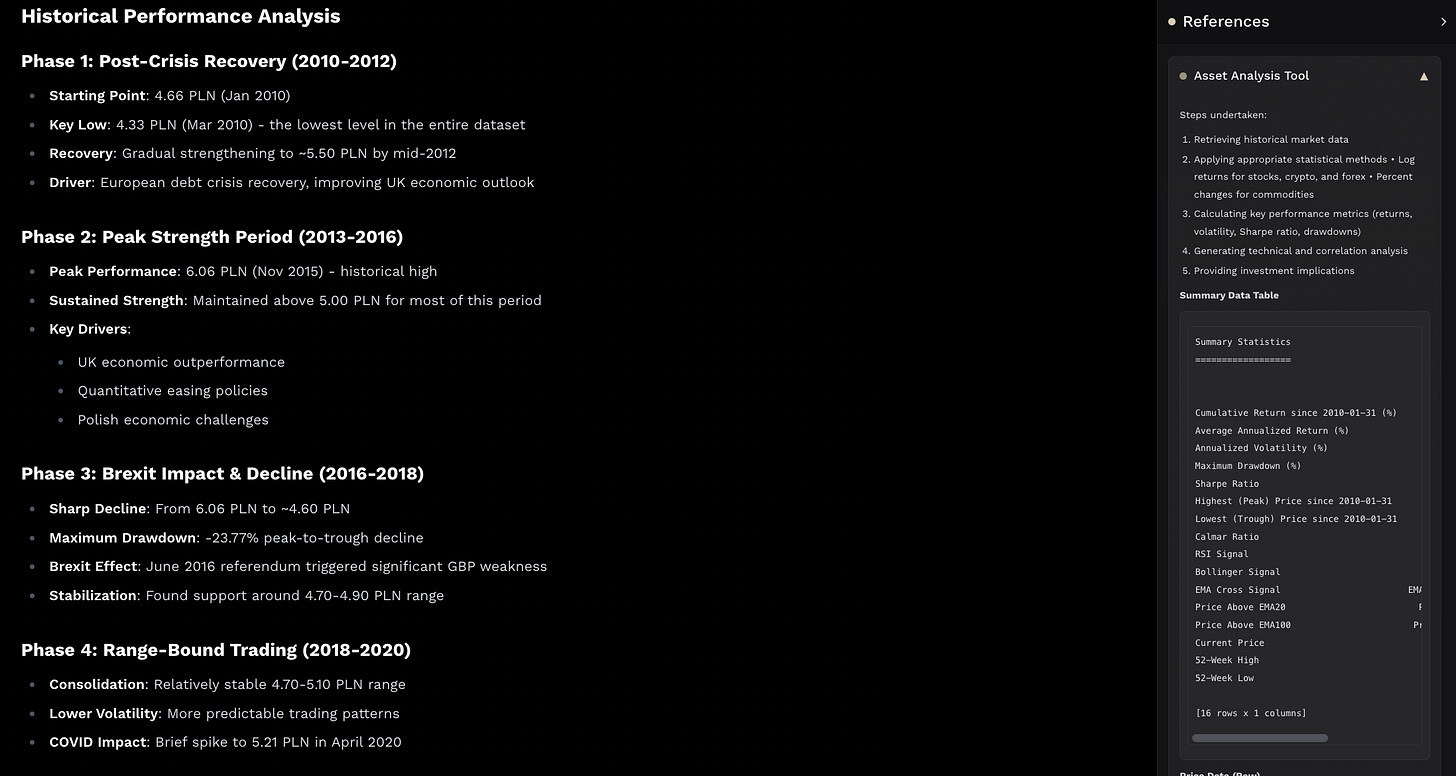

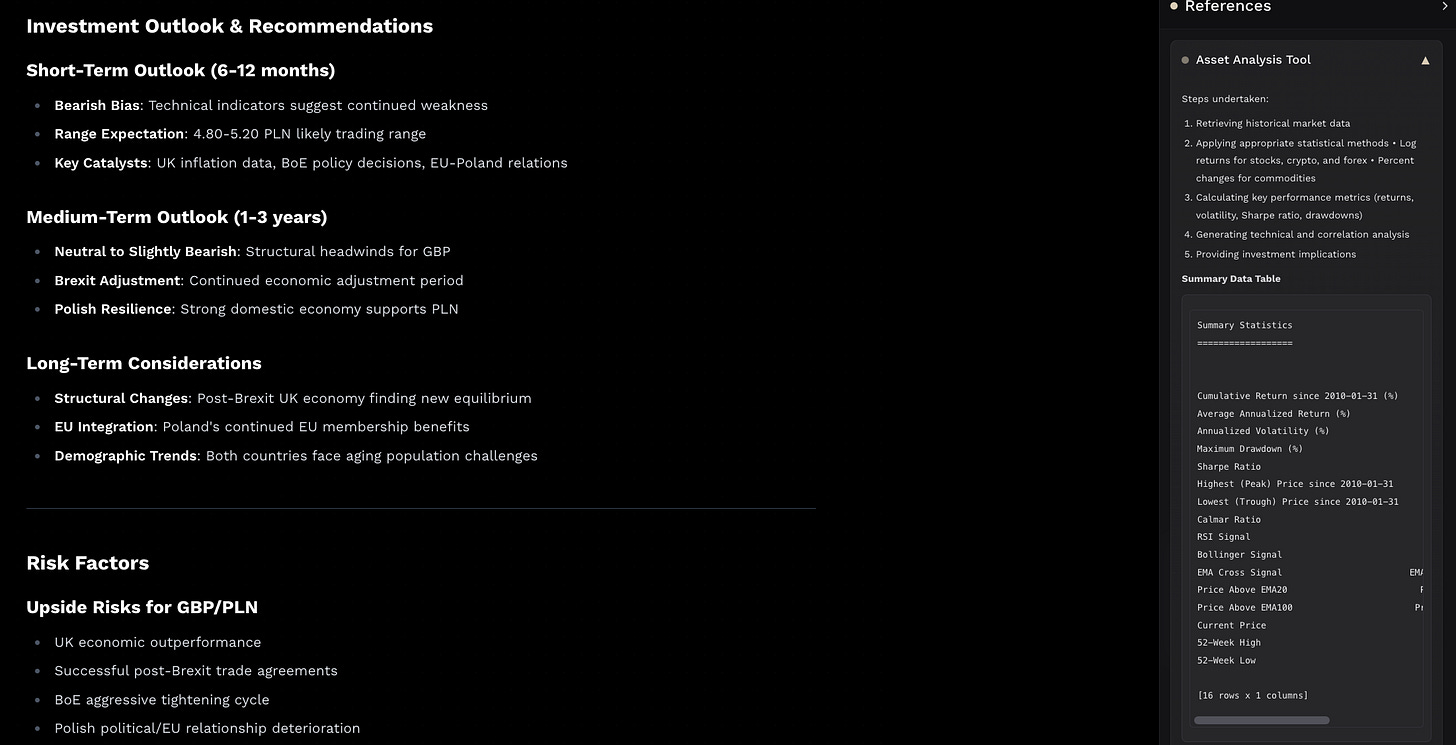

Let’s finish this with currencies, another simple question: “talk to me about gbppln since 2010”

Perplexity Finance answer:

Benjamin AI answer:

Discussion

Same story, Perplexity Finance limits itself to web search, while Benjamin AI nails it with a comprehensive answer.

Advanced queries on assets

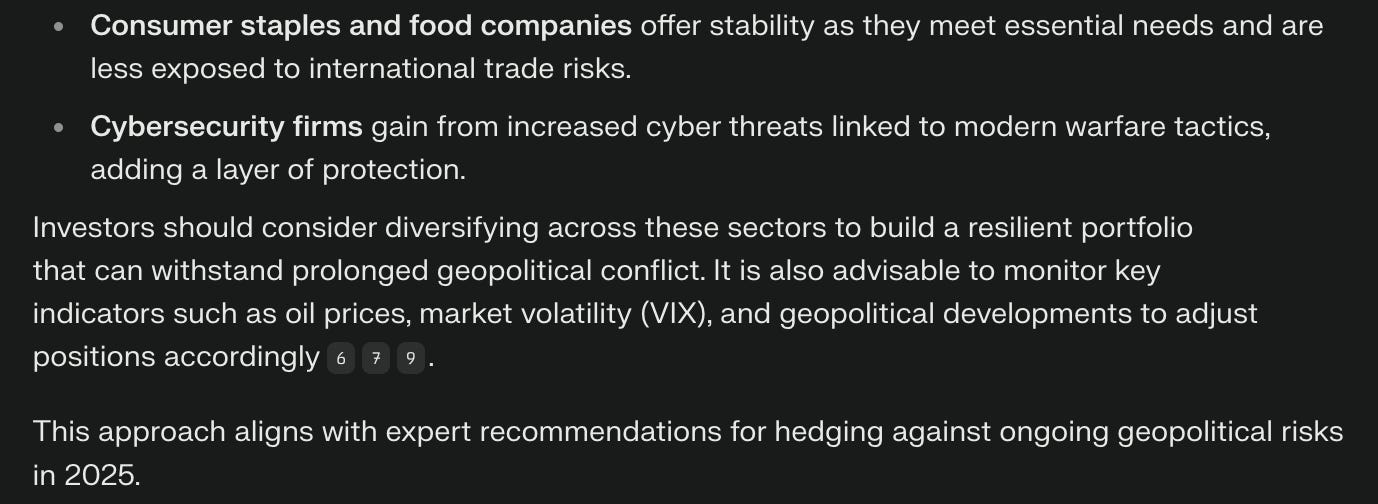

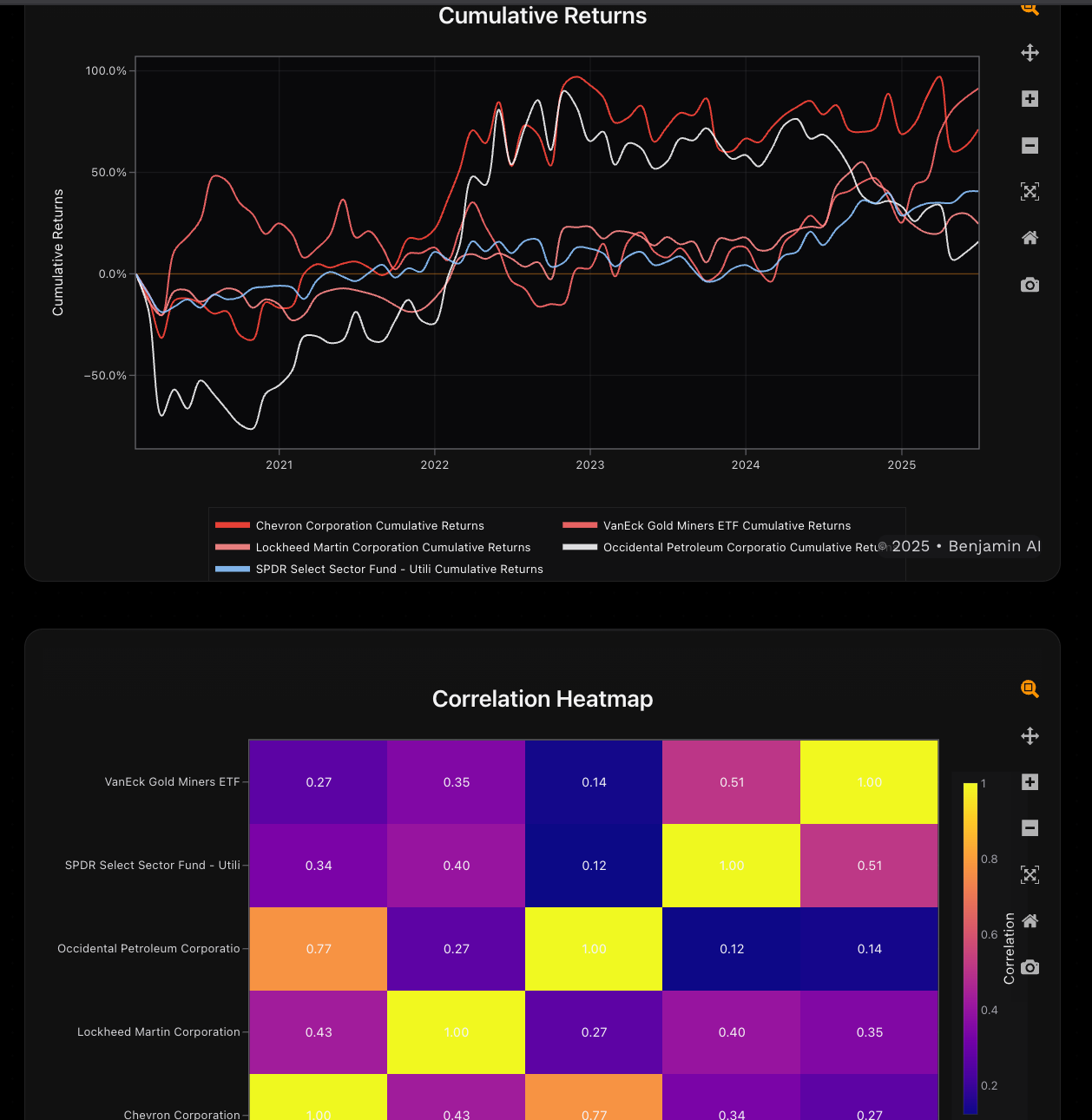

Let’s finish this with more complex questions, like: “given the recent israeli-iran conflict, which stocks do you think would be a good hedge if the war wouldn't actually stop (hypothetically)? give me top 5 and run an analysis on them”

Perplexity Finance answer:

Perplexity Labs: https://www.perplexity.ai/search/given-the-recent-israeli-iran-zluYztqwR4WcWv2I0.gs3A. Similar answer but without the numerical analysis and took way more time.

Benjamin AI answer:

And charts as usual (partial snapshots):

…

Discussion

Sorry for the copied-pasted full query but similarly to other questions, Perplexity Finance’s answer is rather shallow; however, its recommendations are reasonable. Benjamin AI does the job better here by fully analyzing and providing a detailed explanation why these assets.

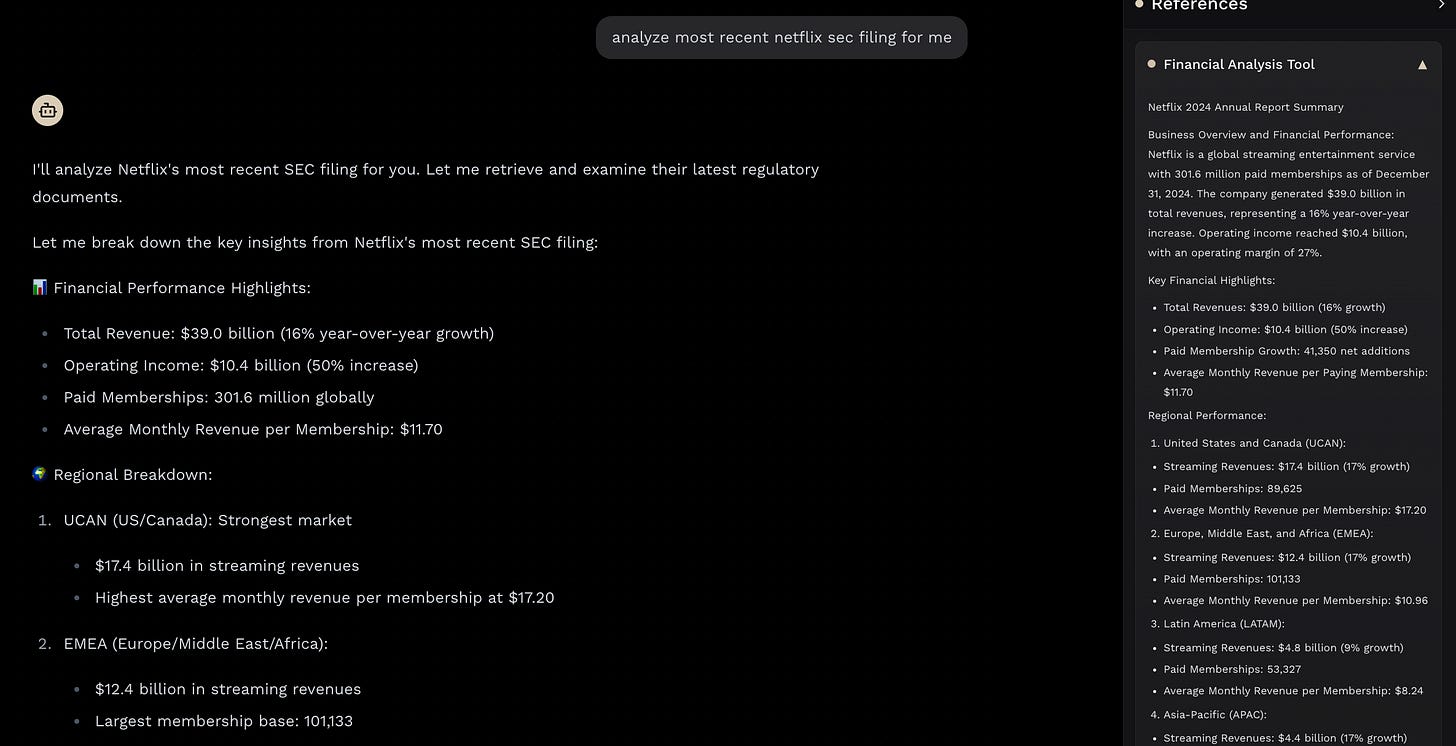

And finally, I have asked about SEC filings: “can you analyze netflix 10ks since 2020”.

Perplexity Finance answer:

Benjamin AI answer:

Discussion

Interestingly, Perplexity Finance pulls a quarterly statement from 2023, while Benjamin AI takes the annual from 2024. However, Perplexity Finance has an upper hand in terms of speed and fetching the filings directly from their Google Drive; Benjamin AI just provides a URL.

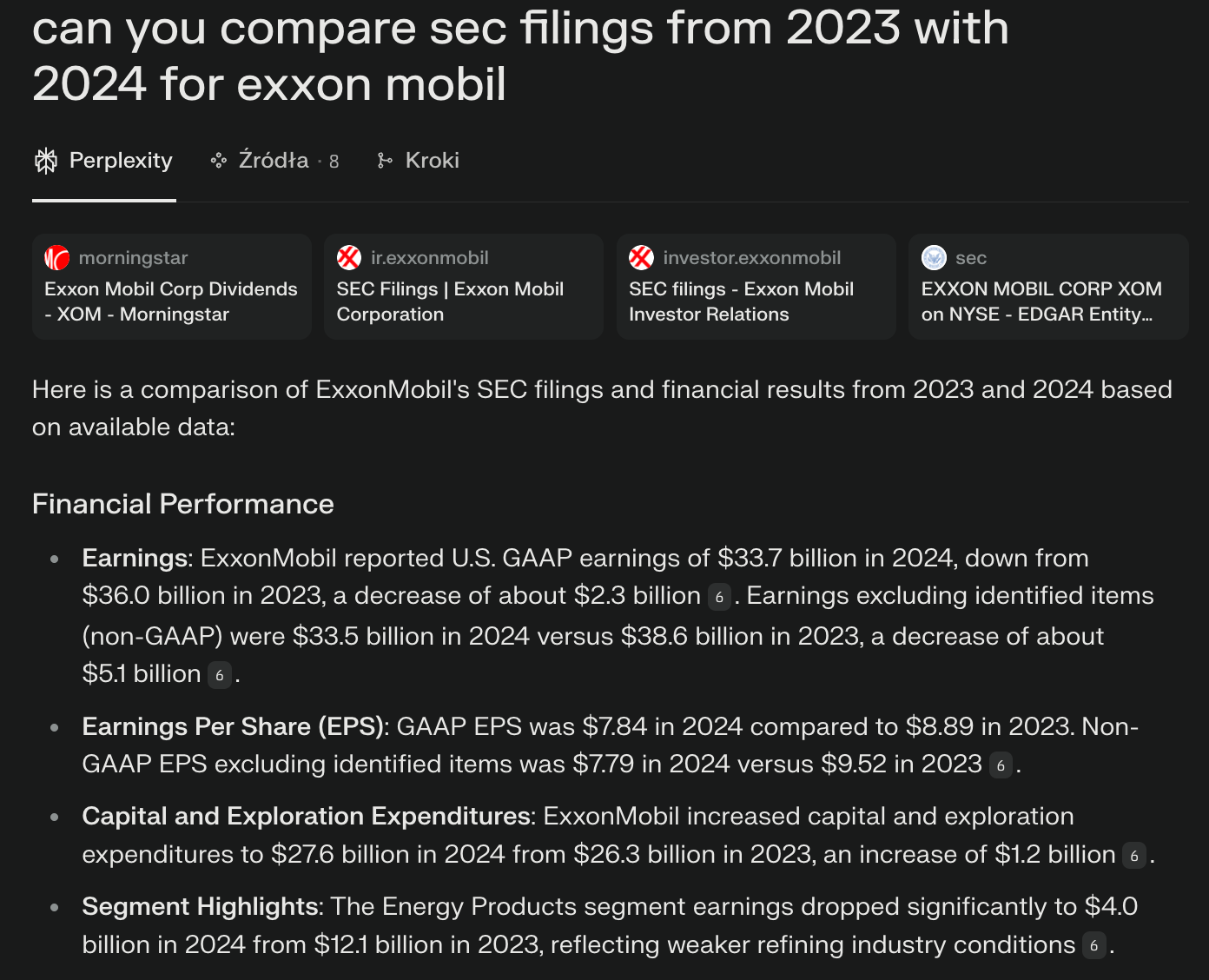

Here is a bit more complex question: “can you compare sec filings from 2023 with 2024 for exxon mobil”

Perplexity Finance answer:

Benjamin AI answer:

Discussion

Perplexity Finance performed better in this area. It not only delivered stronger numerical analysis but also avoided errors related to SEC filings—it linked to the correct documents without issue. In contrast, Benjamin AI struggled: while it sometimes focused on the right time frame (2023–2024), it often provided incorrect links or pulled data from the wrong years. There’s definitely room for improvement in its handling of historical SEC filings, especially if we additionally launch Perplexity Labs here.

Conclusion

There’s still much more that could be compared, but I’ve kept this article to a manageable length—you’re more than welcome to dive deeper on your own.

From this analysis, it’s clear that Perplexity Finance is not yet a tool that quants or portfolio managers can rely on for in-depth financial, data-driven, or macroeconomic analysis. For such tasks, users would likely need to turn to Perplexity Labs, which brings its own set of issues and raises questions about its reliability for professional use.

That said, Perplexity Finance does have notable strengths. Its financial statement and SEC filings analyzer is genuinely impressive, offering a solid foundation for historical financial research. I also appreciated its fast response times—unsurprising given Perplexity’s broader infrastructure—and its convenient sentiment analysis tool. Another useful feature is the ability to fetch SEC filings directly, without needing to paste in a link, unlike with Benjamin AI.

These capabilities make Perplexity Finance a helpful resource for quick insights and document-based queries, even if it currently falls short on the more advanced analytical front.

In the end, I’ll leave the final judgment to you—you may come to a very different conclusion. My goal was simply to highlight that there are alternatives out there, and in my view, some of them perform better in this space.

Thanks for sticking with me through this loooong post!